SAP FICO, SAP FI (Financials) monitors company financials while CO (Controlling) delivers cost accounting. SAP FI is used to store the financial data of an organization and also helps to analyse the financial conditions of a company in the market whereas SAP CO supports coordination, monitoring, and optimization of all the process in the organization. Our training program focuses on core accounting and reporting concepts like financial controlling – credit control, maintain fiscal year variant and tax code, assign the company code to a chart of accounts etc.

Description

SAP is one of the biggest players in the enterprise software application industry which is aimed at superior enterprise resource planning. SAP is the abbreviation for Systems, Applications, and Products in Data Processing. SAP Finance and Controlling (FICO) is one of the most broadly used SAP modules. SAP FICO module includes SAP FICO configuration, SAP CO configuration, SAP FI user and SAP CO user. Taking up a SAP FICO certification is the first step towards beginning a career as a SAP FICO consultant. The different parts of the SAP FI and SAP CO modules are essential to building the skill sets of a SAP FICO consultant or professional.

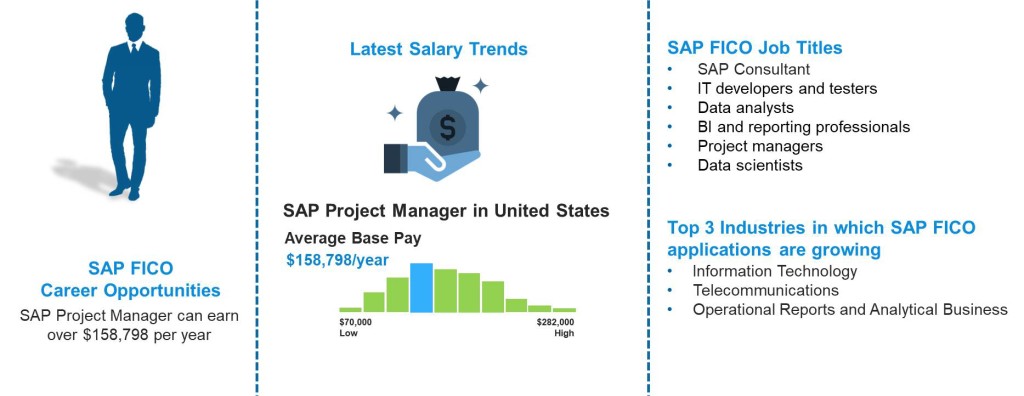

Job Outlook:

Objective

After the completion of SAP FICO course, you will be able to:

- Learn the basic concepts and fundamentals of Finance and Controlling modules

- Learn about General Ledger, Accounts Payable, Bank Accounting and Funds Management and its application in finance analysis

- Learn about Business Process and how FICO Module work in R/3

- Apply Implementation Training and Integration with other Modules

- Apply Real-time Training with End to End Implementation Process

Pre-requisites

- Candidates do not require any specific requirements to take up this course except a basic background in information technology.

- We provide FREE Finance Domain Materials if you want to Learn Basics of Finance and Accounting.

Who should attend this Training?

This certification is highly suitable for a broad range of professionals either aspiring to, or already are in the IT and Finance domain, such as:

- Analytics professionals, professionals desirous of excelling in the fields of accounting and finance

- IT developers and testers

- Data analysts

- BI and reporting professionals

- Project managers

- Data scientists

- Professionals aspiring for a career in growing and demanding fields of real-time big data analytics

- Introduction to ERP, Advantages of SAP over other ERP Packages

- Introduction to SAP R/3 FICO

- Landscape – client concept

- Transport request – creation, structure, types, statuses, releasing and movement

- Definition of company

- Definition of company code

- Assignment of company to company code

- Definition of business area

- Definition of Chart of accounts and types of chart of accounts

- Assignment of chart of accounts to company code

- Definition of Account groups

- Defining Retained Earnings Account

- Definition of fiscal year variant, Short-end fiscal year

- Assignment of fiscal year variant to company code

- Definition of posting period variant

- Assignment of posting period variant to company code

- Open and close FI posting period

- Defining document type & number ranges (internal and external)

- Maintenance of field status variants

- Assignment of field status variant to company code

- Definition of tolerance groups for GL accounts

- Definition of tolerance groups for employees

- Assignment of tolerance groups to users

- Global parameters

- Creation of General Ledger Master (with and without reference)

- Display/Change/Block/Unblock of general ledger master

- Document Entry posting: normal postings and posting with reference

- Display and change of documents

- Display of GL balances

- Display GL account line items

- Parked documents

- Hold documents

- Creation of Sample Document and postings with sample documents

- Creation of account assignment model and posting

- Configuration of line layouts for display of GL line items

- Accrual and Deferral documents

- Reversal of individual documents, mass reversal, reversal of cleared items and reversal of accrual and deferral documents, re-reversal

- Types of clearing – standard, partial and residual

- Defining Exchange Rate types, Forex table and Translation and tables

- Define Exchange rates & posting of foreign currency transactions

- Interest calculations on term loans

- Recurring documents

- Tables and reports in GL

- Creation of vendor account groups

- Creation of number ranges for vendor master records

- Assignment of number ranges to vendor account groups

- Creation of tolerance group for venders

- Creation of vendor master (display/change/block/unblock of vender master) and related tables

- Posting of vendor transactions (invoice posting, manual payment posting, credit memo) and related tables

- Settings for advance payments to parties (down payment) and clearing of down payment against invoices (special GL transactions)

- Posting of partial Payment & Residual Payment

- Cash discounts from vendors and payment terms

- Automatic payment program configuration with SEPA format

- Bank master data and house banks

- F110 execution – main bank posting from F110 and bank clearing account posting from F110 and related tables

- DME files creation in xml and txt format and understanding DME structure in DMEE

- Payment advice generation, payment summary generation

- Reversal of payment documents

- Vendor clearing – standard, partial and residual

- Check payment method and creating checks manually and automatically and printing

- Creation of check lots and maintenance of check register

- Check encashment dates

- Cancellation of unissued checks and issued checks

- Creation of void reasons

- Issued check cancellation

- Deleting manual checks and voided checks

- Defining correspondence & party statement of accounts

- Real-time scenarios on APP

- Intercompany payments – manual and automatic

- Tables and reports in AP and APP

- Creation of customer account groups

- Creation of number ranges for customer master records

- Assignment of number ranges for customer account groups

- Creation of tolerance group for customers

- Creation of customer master (display/change/block/unblock of vender master) and related tables

- Posting of customer transactions (sales invoice posting, manual payment posting, debit memo) and related tables

- Settings for advance payment from parties (down payment)

- Configuration of settings for dunning and generating the dunning letters

- Defining correspondence and party statement of accounts

- Cash discounts to customers

- APP configuration for incoming payments direct debit

- Customer clearing – standard, partial and residual

- Tables and reports in AR

- House bank

- Bank key

- Bank account

- Bank clearing accounts

- Electronic bank statement (EBS): Configuration and execution MT940

- Auto Lockbox: Configuration and execution

- Cash journal/SAP query

- LSMW (master data)

- BDC (transaction data)

- Defining chart of depreciation, depreciation areas

- Creation of 0% tax codes for sales and purchases

- Assignment of the chart of depreciation to company code

- Defining account determination

- Definition of screen layout rules

- Definition of number ranges for asset classes

- Integration with General Ledger & Posting rules

- Defining Depreciation key

- Definition of multilevel methods

- Definition of period control methods

- Creation of main asset master records

- Creation of sub-asset master records

- Acquisition/purchase of fixed assets

- Sale/retirement of fixed assets

- Transfer of assets (intra and intercompany)

- Scrapping of assets

- Depreciation run

- Asset history report, Asset explorer and Asset documents

- Line item Settlement of assets under construction of capital work in progress

- Year-end activities

- Asset mass changes

- Tables and reports in AA

- Parallel ledgers

- Document splitting

- Financial statement version (FSV)

CONTROLLING

- Defining Controlling Area

- Defining Number ranges for Controlling Area

- Maintain versions

- Creation of primary cost elements from FI and CO

- Manual and automatic creation of primary and secondary cost elements

- Grouping of cost elements

- Change cost element master records

- Primary cost element categories and Secondary cost element categories

- Default account assignments

- Defining Cost Center Standard Hierarchy

- Creation of Cost Centers and cost center groups

- Display and change cost center master records

- Creation of cost center groups

- Actual posting to cost centers

- Reposting of CO line items

- Repost of costs

- Planning for cost centers

- Actual and variance reports

- Statistical Key figure

- Creation and execution of Distribution Cycle with/without SKF

- Creation and execution of Assessment cycles with/without SKF

- Creation and execution of Actual periodic reposting

- Defining order types

- Creation of internal order master records

- Display and change internal order master records

- Postings to internal orders

- Planning for internal orders

- Reposting co line items for internal orders

- Repost of costs for internal orders

- Report of Actuals and Variance analysis for internal orders

- Creation of real and statistical internal orders

- Posting of business transaction to real orders

- Definition of allocation structures

- Definition of settlement profiles

- Definition of planning and budget profiles

- Settlement of real internal orders

- Budgeting and availability control

- Maintain number ranges for budgeting

- Define tolerances for availability control

- Specification of exempt cost elements from availability control

- Maintenance of budget manager

- SAP Business workplace

- Basic Settings for Profit Center Accounting

- Creation of Dummy Profit Centers

- Maintenance of control parameters for actual postings

- Maintaining planning versions for profit centers

- Maintenance the number ranges for profit center documents

- Creation, change and display of profit center master records

- Creation of revenue cost elements

- Automatic Assignment of Revenue elements for Profit Centers

- Assignment of profit centers in cost center master records

- Creation of account groups in profit center accounting for planning

- Planning for profit and loss account items

- Planning for balance sheet items

- Posting of transactions into profit centers

- Generating the variance reports for profit and loss account items

- Generating the variance reports for balance sheet items

- Transferring balances from one PC to another PC

- Maintaining the operating concern and related tables

- Define profitability segment characteristics

- Assignment of controlling area to operating concern

- Activating the profitability analysis

- Define number ranges for actual postings

- Mapping of SD conditions types to COPA value fields

- PA transfer structure

- CoPA document generation from Billing and FI document

- Creation of reports – Report painter

- Viewing the reports

Product costing

- Creation of bill of materials BoM

- Creation of activity type master records

- Planning for activity hours

- Activity type price calculation

- Creation of work center master records

- Creation of routings

- Defining cost sheet (overhead structures)

- Assignment of cost sheet to costing variant

- Cost component structure

- Creation of cost estimate with quantity structure

- Marking

- Releasing – price change document

- Creation of cost estimate without quantity structure

- Additive costing

- Base planning object (Reference or Simulation costing)

Integration

- Definition of organizational units in materials management i.e. plant, storage location and purchase organization

- Assignment of organizational units to each other

- Definition of tolerance groups for purchase orders

- Definition of tolerance groups for goods receipt

- Definition of tolerance groups for invoice verification

- Definition of vendor specific tolerances

- Creation, display and change of material master records

- Creation of plant parameters

- Maintenance of posting periods for materials management

- Maintenance of parameters for invoice verification

- Maintenance of plant parameters for inventory management and physical inventory

- Definition of attributes for material types

- Assignment of GL accounts for material transactions in financial accounting (Integration of MM with FI)

- Valuation classes, Valuation grouping code

- Creation of purchase order, posting of goods receipt, invoice verification and Goods issue for production

- Price control – standard and moving average with postings

- GR/IR clearing from F.13

- MM Pricing procedure and adding freight to pricing procedure

- Stock report MB5B

- Definition of sales organization

- Definition of distribution channels

- Definition of divisions and Sales area

- Assignment among various organizational units in SD

- Definition of partner functions

- Definitions of shipping point and loading points

- Definition of pricing procedures

- Determining the shipping points

- Determining the pricing procedures

- Maintenance of SD condition types

- Maintenance of condition records

- Assignment of GL accounts for sales transactions (integration of FI with SD)

- Creation of sales order

- Initialization of stock

- Posting the delivery of goods with PGI

- Creating the sales invoice

- SD pricing procedure

- Line item level

- Header level

- Input tax

- Output tax

- Sales tax procedure

- Structure of an Idoc

- AL11 path, Uploading and downloading files from AL11

- Testing and copying an Idoc

- Reprocessing an Idoc

- Phases in ASAP methodology

- Project plan

- Business blue print (BBP)

- Estimate

- High level design

- Functional specifications

- Test script

- UAT

Your Content Goes Here